UNEMPLOYMENT INSURANCE The 2018 Nevada taxable wage base will be $30,500 (up from $29,500 for 2017), which is based on 66 2/3% of the average annual wage in covered employment for the preceding calendar year rounded to the nearest $100. The tax rate schedule prescribes rates ranging from .25% to 5.4%. Employers will continue to […]

December 18, 2017 | Category:

NewsLast week, the Internal Revenue Service issued the 2018 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical, or moving purposes. Beginning January 1, 2018, the standard mileage rates for the use of a car (including vans, pickups, or panel trucks) will be: 54.5 cents for […]

No business is exempt from a government audit, not even us We recently received a letter from the Nevada Department of Employment, Training and Rehabilitation (“DETR”) stating “Your business has been selected for an audit regarding Nevada Unemployment insurance taxes”. The letter went on to list about a dozen items that an auditor needed to review […]

Make Sure You’re In Compliance on January 1st As we informed you this summer, Governor Sandoval signed Senate Bill 361, providing leave for employees who are victims of domestic violence or whose family or household member is a victim of domestic violence. This new law is set to go into effect next month. We want […]

With the new health care rollout by the Trump Administration your health care plans may have changed for you and your employees. The Trump Administration has just signed an executive order health care in the Roosevelt Room at the White House on Thursday. Following the removal of the birth control mandate for employers, Trump has […]

The White House has announced that employers will be allowed to claim a religious or moral objection to the Affordable Care Act (also known as the ACA or Obamacare) requirement that employer-provided health benefits include no-cost birth control coverage. Under the ACA, non-grandfathered plans must cover eighteen FDA-approved types of contraception, including oral contraceptives, IUDs, […]

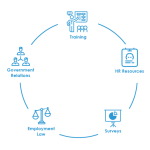

At your workplace, you may have heard about the concept of an employer association. The term is tossed around, but what does an employer association do? Basically, they provide assistance and resources for businesses. The Nevada Association of Employers specializes in HR services, government relations services, navigation of Nevada labor laws, training, and surveys. All of […]

The so-called gig economy, in which temporary positions are common and organizations contract with independent workers for short-term engagements, is slowly changing the face of American business — and forcing employers across the Las Vegas Valley to adjust. A study by Intuit predicted that by 2020, 40 percent of American workers would be independent contractors. […]

Under the Fair Labor Standards Act (FLSA) an employer is permitted to take a tip credit toward its minimum wage obligations for tipped employees equal to the difference between the required cash wage (at least $2.13 per hour) and the federal minimum wage (currently $7.25 per hour). A tipped employee is one who is in […]

Despite efforts in Congress to repeal and/or replace the Affordable Care Act (also known as Obamacare or ACA), it appears, at least for now, that the ACA is here to stay. That means that employers must remain in compliance with the coverage and reporting provisions. Under the ACA, individuals are required to have health insurance and applicable […]