PAYROLL TAXES FOR 2019

Unemployment Insurance

Effective January 1, 2019, the Nevada taxable wage base for calendar year 2019 is $31,200 (up from $30,500 in 2018). The taxable wage base is calculated each year at 66 2/3% of the average annual wage paid to Nevada workers. While total wages paid to each employee must be reported each quarter, unemployment insurance taxes are only paid on an individual’s wages up to the taxable wage base during a calendar year. Employers will continue to be assigned a contribution rate based on their individual experience rating.

The federal taxable wage base will continue to be $7,000 in 2019.

Federal Social Security

Beginning January 1, 2019, the maximum amount of earning subject to the Social Security payroll tax is $132,900—a $4,500 increase from 2018. Social Security and Medicare payroll taxes are collected together as the Federal Insurance Contributions Act (FICA) tax.

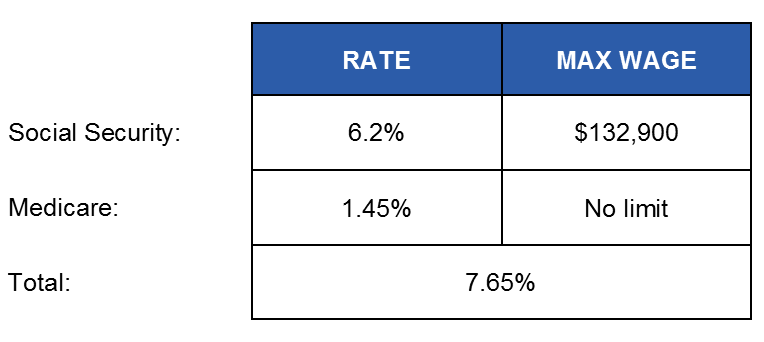

The FICA tax rate for employers (and employees) in 2019 is as follows:

The above tax rates do not include an additional 0.9% in Medicare taxes for highly compensated employees. Under provisions of the Affordable Care Act, the employee-paid portion of the Medicare FICA tax is subject to the 0.9% additional tax on amounts over statutory thresholds. The annual compensation thresholds are $250,000 for married taxpayers who file jointly; $125,000 for married taxpayers who file separately; and $200,000 for single and all other taxpayers. For more information on this additional tax for highly compensated employees, visit the Questions and Answers for the Additional Medicare Tax page on the IRS’s website.

Mailing List Sign Up Form

Fill out this mailing list sign up form to receive monthly email updates on the latest NAE news, HR issues, special events, training dates and more!