DECODING NEVADA UNEMPLOYMENT: WHY PAST EMPLOYEES CAN IMPACT YOU NOW

A frequent call we receive from members involves unemployment claims from former employees who haven’t worked for the business in several months — and in some cases, in over a year. Many of you reading this can relate to the situation where an employee was terminated or resigned, and months later, an unemployment insurance (UI) claim is received. This raises questions about eligibility and leaves you wondering how in the world your company is on the hook for this long-forgotten former employee’s unemployment claim.

It’s a fair question to ask, and the answer can be found in how Nevada has structured its unemployment program.

Understanding the Base Period Year

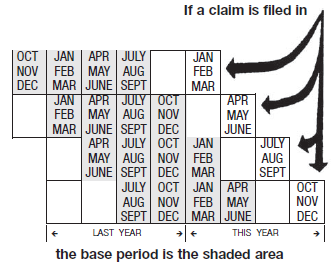

One of the most important terms to understand under Nevada’s unemployment law is base period year. The base period year is defined as the first four (4) of the last five (5) completed calendar quarters before the filing of a claim for benefits.

The chart to the right provides a visual representation of a base period year.

The base period year determines many important aspects of an unemployment claim. It determines if a claimant is monetarily eligible to receive unemployment benefits. It also determines what a claimant’s weekly benefit amount will be. Most importantly, it determines which employers will be charged if benefits are paid out on a claim.

Why Are We Getting This Unemployment Claim?

Well, under Nevada’s unemployment laws, if an employer paid wages to a former employee at any time during that base period year, they may be charged for benefits paid out under that claim. Due to how the base period year is structured, it is not uncommon for an employer to receive an unemployment claim for a former employee long after they are no longer with the company. For example, if a former employee filed an unemployment claim in May 2025, the base period for that claim runs from January through December 2024. That would mean any employer who paid wages to that employee between January and December 2024 could be charged for benefits paid out to that employee.

The secondary questions that tend to follow the initial question are: to what extent will the company be charged benefits for the unemployment claim, and can the company fight having to pay out benefits on this claim? The answer to both of those questions goes right back to the base period year.

Employer Liability for Unemployment Benefits

Under Nevada’s law, if an employer has paid 75% or more of the wages during the base period year, then all benefits will be charged to that employer. If there is no employer who has paid 75% or more of the wages during the base period year, the benefits are charged to all base period employers in proportion to the amount of wages paid.

75% or More Base Period Employers

If an employer is determined to be a 75% or more base period employer, meaning that the employer paid 75% or more of the wages during the base period year, the employer may be able to avoid having the benefits charged to them if they can show that the claimant left their employment voluntarily without good cause, was discharged for misconduct, or was the spouse of an active member of the Armed Forces of the United States and left their employment because their spouse was transferred to a different location. If an employer receives this type of claim, there is much more opportunity to avoid benefits being charged compared to claims where a company is determined to be a less than 75% base period employer.

Less Than 75% Base Period Employers

If it is determined that a company is a less than 75% base period employer, meaning they paid less than 75% of the wages during the base period year, then none of the base period employers can avoid benefits being charged, even if they quit without good cause or were discharged for misconduct. The only way for any of the base period employers to avoid benefits being charged is if the claimant is found to have quit employment with the last or next-to-last employer solely to accept other employment.

Crimes in Connection with Work

All base period employers have the opportunity to avoid benefits being charged when the employee was discharged for crimes in connection with work. However, this isn’t a common occurrence and, when it does, often difficult to prove.

First, the crime cannot just be any crime; it must be a crime in connection with work. For example, an employee receiving a DUI on the way home from a bar on a Saturday night would not be a crime in connection to work, but embezzling from the company would.

Second, the claimant must have been discharged as a result of the crime or crimes in connection with work. The employer must provide one of the following forms of proof: 1) a conviction in a court of law; 2) a signed, written admission of guilt; or 3) an admission under oath in a hearing of record. If an employer cannot provide one of these documents, then the employer will still be charged for benefits paid out under the unemployment claim.

Therefore, an employer’s ability to defend against an unemployment claim and also the amount of benefits that may be charged to an employer all come down to the percentage of wages that the employer paid during the base period year.

Conclusion

It may seem unusual, but in Nevada, receiving an unemployment claim several months or more than a year after an employee has left the company isn’t that uncommon. As a result, employers must keep documentation related to the separation easily accessible, including information for any visit to a local office, to be able to respond to claims filed. Failing to provide all relevant facts or failing to respond timely will prevent you from being able to challenge any benefits charged.

By: Cara Sheehan, Esq.

Looking for assistance with your unemployment claims? NAE can handle the administration of unemployment for your company — from the initial notice of claim through appeal to the Board of Review. We can also handle the daunting task of reviewing your quarterly charge statements for accuracy and filing disputes on your behalf. Interested in learning more? Contact NAE today to discuss this program and how we can support your organization through every step of the unemployment process.

Mailing List Sign Up Form

Fill out this mailing list sign up form to receive monthly email updates on the latest NAE news, HR issues, special events, training dates and more!